Seychelles is a great all round choice for offshore company formation. Some of the key advantages include:

- Enhanced confidentiality laws: Seychelles has strong confidentiality laws that protect the privacy of offshore companies. Directors’ and shareholders’ information is not available to the public, ensuring greater privacy.

- Tax benefits: Seychelles is known for its tax-friendly environment, with no corporate or personal income tax, no capital gains tax, and no withholding tax on dividends or interest.

- Easy company formation: Establishing a company in Seychelles is a straightforward process that can be completed quickly and with minimal paperwork.

- Flexible business laws: Seychelles has modern and flexible business laws that provide great flexibility for business owners. You can easily customize your company structure to suit your specific business needs.

Contact us today to learn more about how we can help you establish your offshore presence in Seychelles.

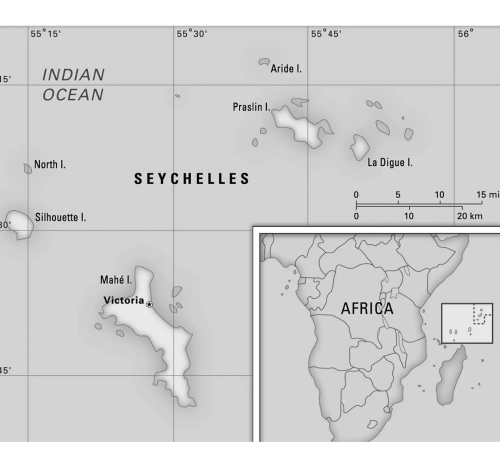

Spotlight on Seychelles:

For enhanced confidentiality laws

Key Facts

- Average Incorporation Time: 10 DAYS

- Nominee Directors Available: YES

- Nominee Shareholders Available: YES

- Average Tax Rate: 0.0%

- Local Administration Fees: LOW

- Local Banking Option: YES + OFFSHORE

Key Benefits

Speed

Privacy

Local Tax Rates